HMRC relies heavily on the Government Gateway system to allow access by tax payers and agents to records. It is therefore important to know how to set these up.

This blog walks you through how to create a government gateway account in the quickest and most straightforward way possible.

Creating and setting up your government gateway account might seem mundane, but ensuring that it is done in the right way will allow you to manage all of your business and personal taxes and their associated details as efficiently as possible.

Instructions on how to create government gateway account

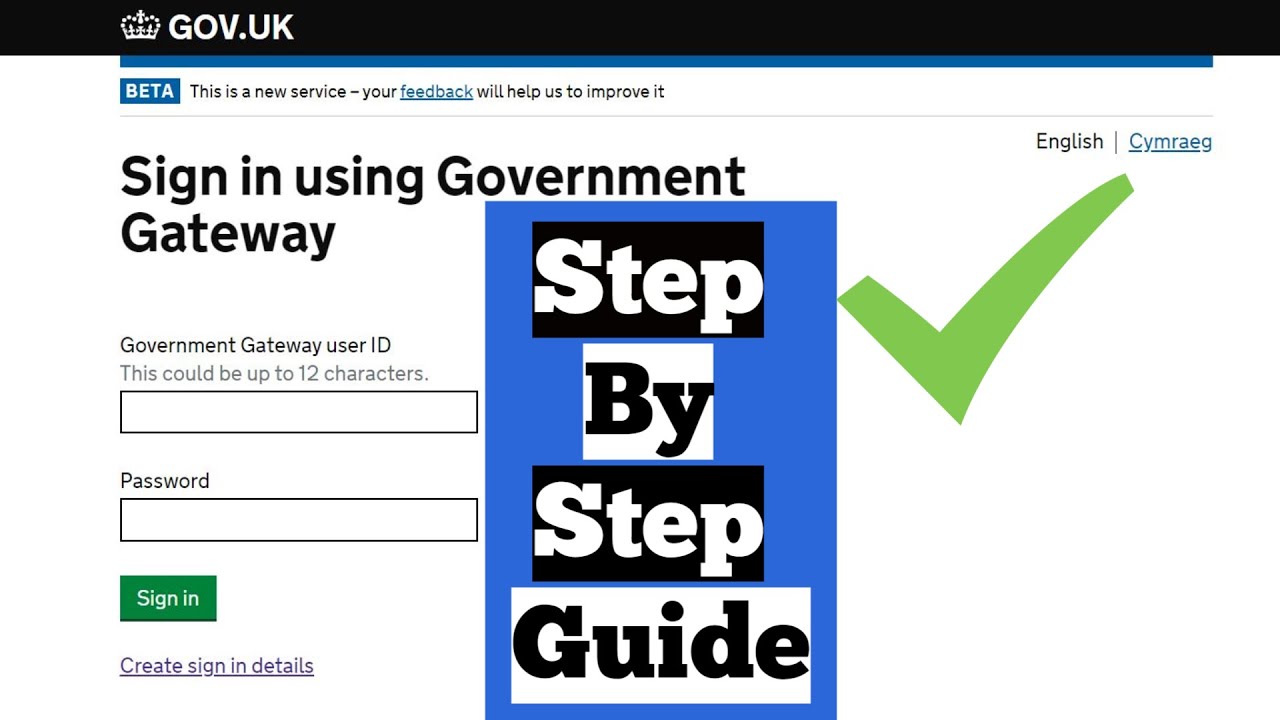

- Go to HMRC’s login page.

- Click the GREEN sign in button.

- Click “Create sign in details”.

- Enter your email address where asked.

- You will now be emailed a confirmation code. Use this code to confirm your email address.

- You will now be issued with a User ID for your government gateway account on screen and this should also be emailed to you.

Print the user ID page to PDF and file it somewhere safe.

The user ID is not easily memorable. Losing this ID can create a lot of work in the future!

You will need to register as an ‘Organisation’ if you are a business, or you represent one, and you require additional HMRC services for business (such as for VAT or PAYE for Employers).

This will then create a Business Tax Account.

The 2-Step Verification process

You will then be asked to complete a process called 2-Step Verification. Having this second layer of security provides added protection should your account details ever be lost or stolen.

To set this up, one option is to provide details of either a mobile phone or landline to which an access code will be sent every time you sign in. If you do not have your own mobile phone or landline you can use somebody else’s but you would need to have access to this phone each time you want to use your account.

Once you have completed 2-Step Verification, you will have to answer some security questions based on information HMRC know about you – you are usually offered a choice between answering questions about your passport or information from your payslips or a recent P60.

If you are unable to do this, you may be asked questions based on information provided by a credit reference agency – for example about your mortgages, loans, bank accounts, phone contracts, known addresses, and so on.

If you are not able to answer the questions, or HMRC does not hold enough information to be able to identify you, you need to discuss next steps with HMRC.

You will now have created your government gateway account:

This only needs to be done once per business.

- You will need to create a separate government gateway account for each business so that the details for each business are held in one place.

- It is sensible to add and activate taxes to your government gateway account as soon as you have registered for them.

- You do not need to add taxes that you are not registered for.

Adding taxes to your government gateway account

Now that you have setup your government gateway account, you need to add each tax that your business has registered for to the account.

The taxes you can add include:

- Corporation Tax

- PAYE for Employers

- VAT

- VAT EC Sales List

Each tax will require specific information relating to that tax (UTR for Corp Tax, VAT certificate and last return filed for VAT, PAYE numbers for PAYE) so ensure that you have any associated information to hand before proceeding.

To add a service you will need to do the following:

- From the business tax summary page, click “get online access to a tax, duty or scheme”.

- Select the tax that you want to add.

- Click the GREEN continue button.

- After you have added the tax HMRC will then post an activation code to your registered office address. This should take about 7-10 days to arrive.

- Once the code arrives, input this into the account and the tax will (finally) be added onto the account. It can take up to 24 hours for the system to update before you can access that tax record.

Repeat these steps for each tax you want to add to your record.

Even when you have created your Government Gateway account and signed up for the online service(s) you want to use, this may not necessarily be the end of the process as many services, including HMRC’s Self Assessment online service, have another level of security.

This requires you to activate the service before you can use it. An on-screen prompt will tell you if this is the case and an activation code will be sent to you by post.

It can take up to 10 days to receive the code or up to 21 days if you live abroad. You must activate the service within 28 days of the date shown on the activation code letter. If you do not, the code will expire and you will have to request a new one.

HMRC guidance explains what to do if you lose your activation code or if it expires.