Up to date news about Amica Accounting and our industry.

Making Tax Digital for the self-employed

Making Tax Digital (MTD) rules will be extended to income tax from 6 April 2026. If you’re a sole trader or landlord earning above £50,000 annually, you’ll need to sign up ahead of the deadline. What does Making Tax Digital mean for the self-employed? Sole traders and landlords with an overall income above £50,000 need to have HMRC-recognised software in place before 6 April 2026. This is when the first phase of Making Tax Digital for Income Tax [...]

Corporation Tax Relief for Salaries

Corporation tax relief is a significant aspect of financial planning for businesses, particularly when it comes to salaries. However, it's crucial to understand that not all forms of remuneration qualify for this relief. For instance, dividends, which come out of pre-tax profits, do not qualify for corporation tax relief. One common misconception is that salaries always get corporation tax relief. In reality, the situation is more nuanced. The term 'always' is seldom used in tax [...]

Tax Investigation Protection Service- FAQs

Every taxpayer who submits a tax return is at risk of a tax investigation - and you needn't have done anything wrong to trigger an investigation. Whether you win or lose, you always have to pay the cost of handling the investigation. Our Tax Investigation Service will cover our professional fees that result from most types of HMRC investigation or enquiry. I’ve done nothing wrong, why should I worry about a tax enquiry? Most [...]

What is a P11D and what is it for?

As well as receiving a monthly salary, employees (which includes directors) can also receive parts of their remuneration in non-monetary form. This could be for example: • the use of a company car • cover given to provide for private medical insurance • employee personal bills paid for by the company • the company providing living accommodation • the company giving an employee an asset to use privately • loans given to an employee [...]

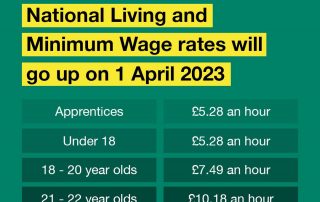

National Minimum Wage – The New Rates From April 2023

How much per hour is the National Living Wage? From April 2023 the new rate is £10.42 per hour. The rate is currently £9.50 (2022/23 tax year) Who qualifies for the National Living Wage? In April 2021 the qualifying age was raised to those aged 23 years old and over. This will remain the same in the next tax year 2023/24. NOTE: Prior to April 2021 the qualifying age was 25 years old and over. What [...]

How To Pay Your Personal Tax Liability?

Who needs to pay personal tax UK individuals who are registered for self-assessment must pay their personal tax liabilities by 31st January each year. A further payment maybe due by 31st July if you are required to make payments on account. How to pay your personal tax liability using your mobile phone? In our opinion, the most convenient way to pay your personal tax liability is using the HMRC app on your mobile phone. [...]

Making Tax Digital For Income Tax – Delayed

Making tax digital for income tax has been delayed until April 2026. This effects all self-employed individuals, landlords and partnerships. What is making tax digital for income tax? Making tax digital is a HMRC initiative, which requires businesses to use software to maintain their record of income and expenses. The most popular software providers on the market are Excel, Quickbooks, Sage and Xero. What was due to happen? From April 2024, all self-employed individuals and [...]

What’s the Most Tax Efficient Director’s Salary in 2023/24?

As a director you’re legally separate from your limited company, even if you’re also the owner. This means that you’re not allowed to simply keep the profits for yourself in the same way that a sole trader can. Instead, you’ll need to decide how much to pay yourself. The most tax-efficient way to take an income from your own limited company is normally through a combination of a low salary (in the same way as [...]

SELF ASSESSMENT FACTSHEET 2022-2023

Self-Assessment is a system HM Revenue and Customs (HMRC) uses to collect Income Tax. Tax is usually deducted automatically from wages, pensions, and savings. People and businesses with other income such as Self-Employed, (including COVID-19 grants and support payments) must report it in a tax return. DO I NEED TO FILE A SELF ASSESSMENT TAX RETURN? You will need to file a Self-Assessment tax return if you are: self-employed as a ‘sole trader’ and earned [...]

Self Assessment- Understanding the Basics

What is Self Assessment? You tell HMRC about your taxable income and gains for a tax year by completing a Self Assessment tax return. Part of the process is to work out and pay what you owe. When do I have to complete a Self Assessment tax return? You must fill in a tax return if HMRC have sent you a ‘notice to file’ asking you to do so. This is the case unless [...]

How to Create an Invoice in XERO

When you’re in the sales invoice screen you have the choice of using new or classic invoicing. Classic invoicing requires you to manually enter all the information, while new invoicing prefills many of the details for you and automatically saves your work. To check which one you’re on, see the link at the bottom of the screen. If it says Switch to new invoicing, then you’re on the classic invoicing screen. If it says Switch to classic invoicing, then [...]

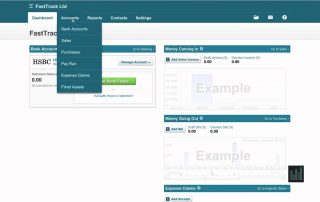

How to Connect a Bank Feed in XERO

Getting Started With Xero Bank Feeds: Edit Your Bank Details To set up bank feeds in Xero, you’ll need to go to “Accounting”, then “Bank Accounts”. From here, simply follow these steps: On the account, you want to add a bank feed, so click “Manage Account”, then “Edit Account Details”. In the “Your Bank” box, type in the name of your bank account. Please ensure that you choose the right one, bearing in mind that [...]