Up to date news about Amica Accounting and our industry.

Digital Tools Every Modern Business Needs for Accounting

In today’s fast-paced business world, staying on top of your finances requires more than just a spreadsheet and a filing cabinet. Modern businesses rely on digital tools to streamline accounting, improve accuracy, and gain real-time insights into their financial health. Here’s a rundown of the essential digital tools every business should consider. 1. Cloud Accounting Software Cloud-based accounting platforms, like Xero, allow businesses to manage their finances anytime, anywhere. They automate bookkeeping tasks, integrate with [...]

Why Virtual Accountancy is Changing the Game for SMEs

The way small and medium-sized businesses manage their finances is evolving fast, and virtual accountancy is leading the charge. Gone are the days when bookkeeping and tax advice meant piles of paperwork and endless office visits. Today, technology allows businesses to access expert financial support anytime, anywhere — and the benefits are game-changing. 1. Flexibility and Convenience Virtual accountancy means you’re no longer tied to traditional office hours or location. SMEs can interact with their [...]

New VAT Rules Explained for 2025

The VAT landscape in the UK has undergone significant changes in 2025, impacting businesses of all sizes. Whether you're a small enterprise or a large corporation, staying informed about these updates is crucial for compliance and financial planning. Here's a breakdown of the key VAT changes you need to know: 1. Increased Late Payment Interest Rates Starting from 6 April 2025, HMRC has increased the rate of late payment interest from 2.5% above the Bank [...]

MAKING TAX DIGITAL FOR INCOME TAX

Making Tax Digital for Income Tax Self Assessment (MTD for ITSA) is a UK government initiative designed to digitise the tax system for individuals who are self-employed or landlords. Here's a breakdown of what it means, who it affects, and what you need to do: What is MTD for ITSA? Making Tax Digital for Income Tax Self Assessment (MTD for ITSA) is a government initiative that requires taxpayers to: Keep digital records of income and [...]

LIMITED COMPANY vs SOLE TRADER; WHICH IS BEST FOR YOU?

Choosing a business structure is one of the most important decisions a business owner needs to make, but it can be difficult to understand your options. We have outlined just some of the advantages and disadvantages of being either a Sole Trader or running a Limited Company. ADVANTAGES OF BEING A SOLE TRADER. Start immediately: There is no requirement to register with Companies House so you can setup and start your business whenever you want too. [...]

Making Tax Digital for the self-employed

Making Tax Digital (MTD) rules will be extended to income tax from 6 April 2026. If you’re a sole trader or landlord earning above £50,000 annually, you’ll need to sign up ahead of the deadline. What does Making Tax Digital mean for the self-employed? Sole traders and landlords with an overall income above £50,000 need to have HMRC-recognised software in place before 6 April 2026. This is when the first phase of Making Tax Digital for Income Tax [...]

Corporation Tax Relief for Salaries

Corporation tax relief is a significant aspect of financial planning for businesses, particularly when it comes to salaries. However, it's crucial to understand that not all forms of remuneration qualify for this relief. For instance, dividends, which come out of pre-tax profits, do not qualify for corporation tax relief. One common misconception is that salaries always get corporation tax relief. In reality, the situation is more nuanced. The term 'always' is seldom used in tax [...]

Tax Investigation Protection Service- FAQs

Every taxpayer who submits a tax return is at risk of a tax investigation - and you needn't have done anything wrong to trigger an investigation. Whether you win or lose, you always have to pay the cost of handling the investigation. Our Tax Investigation Service will cover our professional fees that result from most types of HMRC investigation or enquiry. I’ve done nothing wrong, why should I worry about a tax enquiry? Most [...]

What is a P11D and what is it for?

As well as receiving a monthly salary, employees (which includes directors) can also receive parts of their remuneration in non-monetary form. This could be for example: • the use of a company car • cover given to provide for private medical insurance • employee personal bills paid for by the company • the company providing living accommodation • the company giving an employee an asset to use privately • loans given to an employee [...]

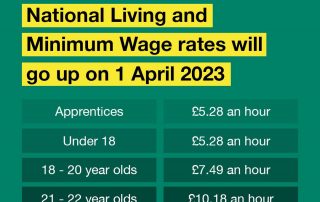

National Minimum Wage – The New Rates From April 2023

How much per hour is the National Living Wage? From April 2023 the new rate is £10.42 per hour. The rate is currently £9.50 (2022/23 tax year) Who qualifies for the National Living Wage? In April 2021 the qualifying age was raised to those aged 23 years old and over. This will remain the same in the next tax year 2023/24. NOTE: Prior to April 2021 the qualifying age was 25 years old and over. What [...]

How To Pay Your Personal Tax Liability?

Who needs to pay personal tax UK individuals who are registered for self-assessment must pay their personal tax liabilities by 31st January each year. A further payment maybe due by 31st July if you are required to make payments on account. How to pay your personal tax liability using your mobile phone? In our opinion, the most convenient way to pay your personal tax liability is using the HMRC app on your mobile phone. [...]

Making Tax Digital For Income Tax – Delayed

Making tax digital for income tax has been delayed until April 2026. This effects all self-employed individuals, landlords and partnerships. What is making tax digital for income tax? Making tax digital is a HMRC initiative, which requires businesses to use software to maintain their record of income and expenses. The most popular software providers on the market are Excel, Quickbooks, Sage and Xero. What was due to happen? From April 2024, all self-employed individuals and [...]