Up to date news about Amica Accounting and our industry.

What’s the Most Tax Efficient Director’s Salary in 2023/24?

As a director you’re legally separate from your limited company, even if you’re also the owner. This means that you’re not allowed to simply keep the profits for yourself in the same way that a sole trader can. Instead, you’ll need to decide how much to pay yourself. The most tax-efficient way to take an income from your own limited company is normally through a combination of a low salary (in the same way as [...]

SELF ASSESSMENT FACTSHEET 2022-2023

Self-Assessment is a system HM Revenue and Customs (HMRC) uses to collect Income Tax. Tax is usually deducted automatically from wages, pensions, and savings. People and businesses with other income such as Self-Employed, (including COVID-19 grants and support payments) must report it in a tax return. DO I NEED TO FILE A SELF ASSESSMENT TAX RETURN? You will need to file a Self-Assessment tax return if you are: self-employed as a ‘sole trader’ and earned [...]

Self Assessment- Understanding the Basics

What is Self Assessment? You tell HMRC about your taxable income and gains for a tax year by completing a Self Assessment tax return. Part of the process is to work out and pay what you owe. When do I have to complete a Self Assessment tax return? You must fill in a tax return if HMRC have sent you a ‘notice to file’ asking you to do so. This is the case unless [...]

How to Create an Invoice in XERO

When you’re in the sales invoice screen you have the choice of using new or classic invoicing. Classic invoicing requires you to manually enter all the information, while new invoicing prefills many of the details for you and automatically saves your work. To check which one you’re on, see the link at the bottom of the screen. If it says Switch to new invoicing, then you’re on the classic invoicing screen. If it says Switch to classic invoicing, then [...]

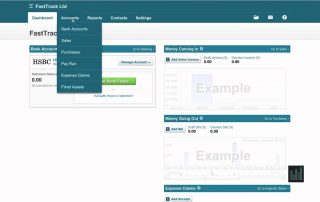

How to Connect a Bank Feed in XERO

Getting Started With Xero Bank Feeds: Edit Your Bank Details To set up bank feeds in Xero, you’ll need to go to “Accounting”, then “Bank Accounts”. From here, simply follow these steps: On the account, you want to add a bank feed, so click “Manage Account”, then “Edit Account Details”. In the “Your Bank” box, type in the name of your bank account. Please ensure that you choose the right one, bearing in mind that [...]

How to Use the DEXT Mobile App – FOR CLIENTS

How to Use the Dext Mobile App The Dext Prepare Mobile app is the quickest and easiest way to submit your receipts, invoices and other documents to Dext Prepare. How to Access the App Amica Accounting will send you an invitation to use the Dext mobile app via text message. This makes the process nice and simple. 1. Click on the link within the text message. 2. Enter your password and click Create Account 3. Follow [...]

Claiming back VAT

When you can claim VAT back You can claim VAT back when: you’ve purchased goods or services for your business a customer leaves you with a bad debt VAT on business expenses When you buy something for your business, you’re usually charged VAT. If you’re registered for VAT, you can claim that back. You do this by reporting how much VAT you paid during a period of time. HMRC balances the amount you’ve paid against [...]

How to Register for VAT

Who needs to register for VAT? Some businesses have to register for VAT, some aren’t allowed to, and others can choose. Who must register for VAT: Businesses with an annual taxable turnover of more than £85,000. You may be fined if you don’t register. Who is not allowed to register for VAT: Businesses that sell only VAT-exempt goods and services. Who can choose to register for VAT: Businesses with an annual taxable turnover of less than £85,000. Benefits [...]

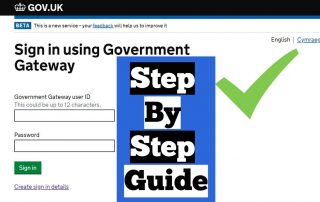

How to set up Government Gateway Account for your Business

HMRC relies heavily on the Government Gateway system to allow access by tax payers and agents to records. It is therefore important to know how to set these up. This blog walks you through how to create a government gateway account in the quickest and most straightforward way possible. Creating and setting up your government gateway account might seem mundane, but ensuring that it is done in the right way will allow you to manage [...]

12 Self-Assessment expenses you didn’t know you could claim!

There are many allowable expenses you can claim to legitimately reduce the amount of tax you pay. We’ve rounded up 12 Self Assessment expenses that you may be unaware of. To help you to start saving money, take a look at our list of Self Assessment expenses you can claim against your tax bill. 1. Office supplies HMRC will allow you to claim a range of expenses pertaining to office supplies, including: • Your desk [...]

Making Tax Digital for VAT is coming – are you ready?

HMRC urges VAT-registered businesses to sign up for Making Tax Digital for VAT before 1 April 2022. As of December 2021, nearly 1.6 million taxpayers had joined Making Tax Digital for VAT with more than 11 million returns successfully submitted. Around a third of VAT-registered businesses with taxable turnover below £85,000 have voluntarily signed up to Making Tax Digital for VAT ahead of April 2022, and thousands more are signing up each week. In July 2020, it was announced that [...]

How to register as self-employed

How to register as self-employed with HMRC – step by step We’ll take you through the process in depth, but here’s a quick overview of how to register as self-employed: Check your work counts as self-employment Register for an online account with gov.uk Complete your registration using your Government Gateway details, as well as information about your business, like your trading name and contact details Once registered as self-employed you'll have a number of obligations and responsibilities, like completing an [...]